Investments

Key Financial & Growth Performance

Our Competitive Edge

Invest in profit-generating portfolios in the world’s top education hubs with our global portfolios.

We place high importance on the financial returns and it is evident with our profit growth of 23% from S$46.5 million in FY2021 to S$57.1 million in FY2022.

With our global accommodation management experience, our management works closely with local government agencies to ensure our properties are compliant to the local regulations.

Swift implementation of our Business Continuity Plan and Pandemic Management Plan, minimising the pandemic’s disruption to our business and residents’ wellbeing.

We have strong financial management platforms and processes in place. With prudent cost management, our group’s segment margins for student accommodation improved 7% from FY2021 to FY202 despite knock-on effects of the global pandemic and inflationary pressures.

Key Opportunities

AU – Under-supplied PBSA as International Students Return

As borders re-opened and international students are welcomed back into the country, international students are steadily returning to Australia, but face a severe shortage of accommodations. Growth in student population and demand for PBSA are expected to continue, following China’s move to end recognition of online degrees.

USA – Portfolio Assets Continue to Deliver Healthy and Stable Occupancy

In 2022, our US portfolio remains strong with year-on-year growth in financial occupancy and rental rates, supported mainly by strong domestic demand.

UK – Ability to Attract Growing Domestic Demand

The UK maintains as one of the top tertiary education markets in the world. However, with the pandemic throttling travel and face-to-face teaching, demand from international students is relatively uncertain compared to domestic demand. Our UK assets will continue to attract demand from growing domestic student population, as well as continued pent-up demand from multiple international student source countries.

Case Studies

We Develop Success

We Identify Growth Opportunities

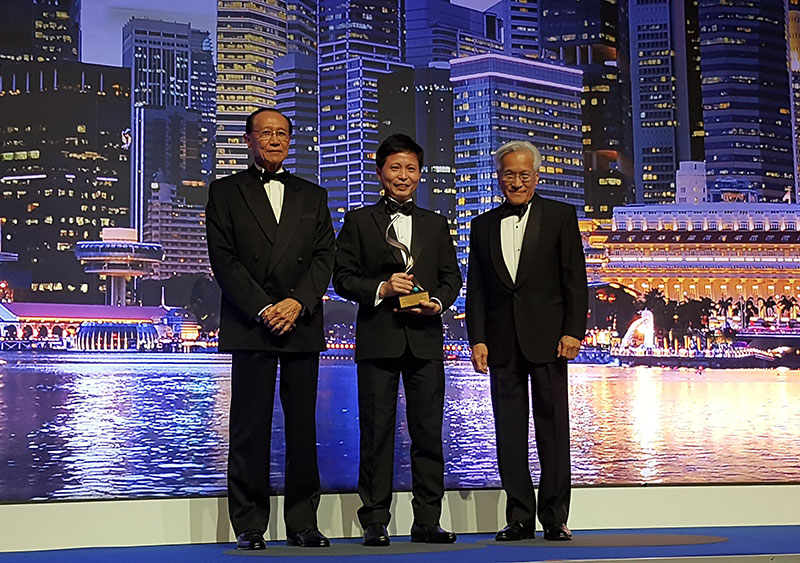

About Centurion Corporation Limited

Our Parent Company

Centurion Corporation Limited is the only SGX-listed and SEHK-listed company offering investors exposure to the attractive workers and student accommodation sector. Centurion was listed on the SGX in 1995, and dual primary listed the SEHK on 12 December 2017. Since 2014, Centurion’s diversified portfolio now comprises of 66,291 beds across 36 quality, purpose built student and workers accommodation assets located in six geographic markets across the world.

Feedback Form

Or send us an email at info@dwellstudent.com.